Bernard Madoff Did Not Purchased Any Securities for His Customers. There is no evidence that Bernard Madoff purchased any securities for his customers in the past 13 years, according to a court appointed trustee who is overseeing the liquidation of the accused Ponzi schemer’s assets. According to an Associated Press report, for more than a […]

Bernard Madoff Did Not Purchased Any Securities for His Customers. There is no evidence that Bernard Madoff purchased any securities for his customers in the past 13 years, according to a court appointed trustee who is overseeing the liquidation of the accused Ponzi schemer’s assets. According to an Associated Press report, for more than a decade, the monthly account statements Madoff investors received were nothing more than elaborate works of fiction.

The 70-year-old Madoff was arrested on one count of securities fraud on December 11. Madoff – once a chairman of the Nasdaq stock exchange – is the founder and primary owner of Bernard L. Madoff Investment Securities LLC. The firm is primarily known for its business in market-making, or serving as the middleman between buyers and sellers of shares. However, Madoff also oversaw an investment-advisory business that managed money for high-net-worth individuals, hedge funds and other institutions.

According to the FBI complaint against Madoff, that business was largely a Ponzi scheme. The FBI said Madoff “deceived investors by operating a securities business in which he traded and lost investor money, and then paid certain investors purported returns on investment with the principal received from other, different investors, which resulted in losses of approximately billions of dollars.” Some estimates say those losses could reach as much as $50 billion.

Shortly after Madoff’s arrest, a federal judge ordered that his business be liquidated under the jurisdiction of a bankruptcy court and assigned a trustee to oversee that process. According to the Associated Press, at a meeting last Friday in New York, the trustee updated hundreds of investors on his efforts. At that meeting, they were told that a search of records going back almost to 1993 had found no evidence that any securities were bought for investors during that time. The trustee told investors he has not yet been able to search records before 1993, but warned that when such a search occurs, there is a good chance it will produce similar results.

The trustee also told investors that so far, $950 million has been recovered from Madoff’s assets. The money could eventually be used to cover some losses, but it is a mere fraction of what investors entrusted to Madoff. Along with proceeds from the sale of assets, victims could qualify for up to $500,000 in funds from the Securities Investor Protection Corp., or SIPC, the Associated Press said.

Investors were also told that the trustee would seek to recover phony profits earned by some investors so they can be redistributed to others, the Associated Press said. An attorney working for the trustee pointed out that any such profits were “just made up”, and the investors who received them “got somebody else’s money.”

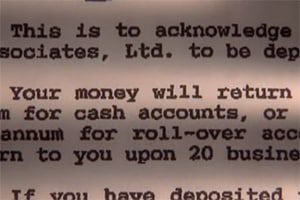

In the end, Friday’s meeting raised just as many questioned as it answered. For instance Madoff’s alleged fraud seems even more stunning in light of the fact that his investors received detailed account statements from him every month for several decades. Madoff has reportedly maintained that he acted alone. But it is hard to believe that he compiled thousands of false investor account statements by himself.

The personal injury attorneys at Parker Waichman LLP offer free, no-obligation case evaluations. For more information, fill out our online contact form or call 1-800-YOURLAWYER (1-800-968-7529).